simferopoll.ru

Market

Gsew

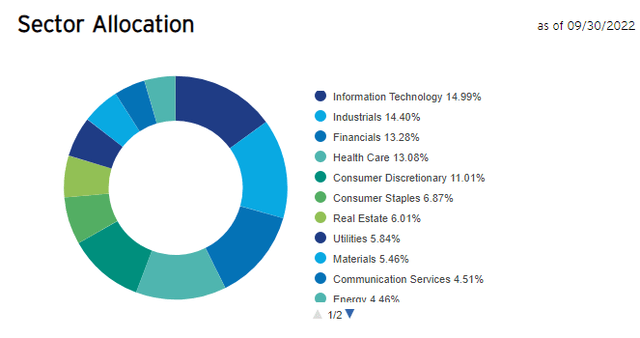

Get the latest news of GSEW from simferopoll.ru Our Research, Your Success. GSEW ETF Factor Report. Data as of market close on: 7/26/ Validea's ETF Factor Report offers a fundamental analysis of any ETF using the major. By tracking an index that equally weights the largest U.S. equities and rebalancing monthly, GSEW seeks to avoid concentration in the largest names. Goldman Sachs Equal Wght US Lg Cp Eq ETF (GSEW) is a passively managed U.S. Equity Large Blend exchange-traded fund (ETF). Goldman Sachs launched the ETF in. Stock Price and Dividend Data for Equal Weight US Large Cap Equity ETF Pricing Basket/Goldman Sachs ETF Trust (GSEW), including dividend dates. Latest Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW:BTQ:USD) share price with interactive charts, historical prices, comparative analysis. Learn everything you need to know about Goldman Sachs Equal Wght US Lg Cp Eq ETF (GSEW) and how it ranks compared to other funds. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW). Review the latest GSEW Morningstar rating and analysis on the ETF to determine if it is the right investment decision for your goals. Get the latest news of GSEW from simferopoll.ru Our Research, Your Success. GSEW ETF Factor Report. Data as of market close on: 7/26/ Validea's ETF Factor Report offers a fundamental analysis of any ETF using the major. By tracking an index that equally weights the largest U.S. equities and rebalancing monthly, GSEW seeks to avoid concentration in the largest names. Goldman Sachs Equal Wght US Lg Cp Eq ETF (GSEW) is a passively managed U.S. Equity Large Blend exchange-traded fund (ETF). Goldman Sachs launched the ETF in. Stock Price and Dividend Data for Equal Weight US Large Cap Equity ETF Pricing Basket/Goldman Sachs ETF Trust (GSEW), including dividend dates. Latest Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW:BTQ:USD) share price with interactive charts, historical prices, comparative analysis. Learn everything you need to know about Goldman Sachs Equal Wght US Lg Cp Eq ETF (GSEW) and how it ranks compared to other funds. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW). Review the latest GSEW Morningstar rating and analysis on the ETF to determine if it is the right investment decision for your goals.

View Goldman Sachs Equal Weight U.S. Large Cap Equity Etf (GSEW) stock price, news, historical charts, analyst ratings, financial information and quotes on. Equal Weight U.S. Large Cap Equity ETF (GSEW) ; Price/Earnings ttm ; Annual Dividend & Yield (%) ; Most Recent Dividend on 03/22/ Equity ETF (GSEW) to its benchmarks. Cumulative Returns %. Annualized Returns %. Goldman Sachs Equal Weight. U.S. Large Cap Equity ETF. Market. + + +. The Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW) is an exchange-traded fund that mostly invests in large cap equity. GSEW launched in with a management fee of 9 basis points, competitive with plain-vanilla U.S. equity funds and making it one of the cheapest equal-weight. Cboe: GSEW. Listed September 14, The Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (the Fund) seeks to provide investment results that closely. Find the latest quotes for Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW) as well as ETF details, charts and news at simferopoll.ru Latest Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW:BTQ:USD) share price with interactive charts, historical prices, comparative analysis. GSEWCBOE BZX Exchange • delayed by 15 minutes • USD. Goldman Sachs Equal Weight US Large Cap Equity ETF (GSEW). at close. (%). after hours. GSEW's dividend yield, history, payout ratio & much more! simferopoll.ru: The #1 Source For Dividend Investing. Goldman Sachs Equal Weight US Large Cap Equity ETF advanced ETF charts by MarketWatch. View GSEW exchange traded fund data and compare to other ETFs. View the latest Goldman Sachs Equal Weight US Large Cap Equity ETF (GSEW) stock price and news, and other vital information for better exchange traded fund. GSEWCBOE BZX Exchange • delayed by 15 minutes • USD. Goldman Sachs Equal Weight US Large Cap Equity ETF (GSEW). at close. (%). after hours. GSEW: Goldman Sachs Equal Weight U.S. Large Cap Equity ETF - Fund Chart. Get the lastest Fund Chart for Goldman Sachs Equal Weight U.S. Large Cap Equity ETF. A list of holdings for GSEW (Goldman Sachs Equal Weight U.S. Large Cap Equity ETF) with details about each stock and its percentage weighting in the ETF. The ETF Goldman Sachs Equal Weight U.S. Large Cap Equity ETF has the ticker symbol GSEW. The latest price for GSEW is with net assets at. The Year-to-Date. GSEW - Goldman Sachs Equal Weight U.S. Large Cap Equity ETF - Stock screener for investors and traders, financial visualizations. GSEW Stock Price Chart Interactive Chart > · Price chart for GSEW. Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW) ETF Bio. The investment objective. The ETF Goldman Sachs Equal Weight U.S. Large Cap Equity ETF has the ticker symbol GSEW. The latest price for GSEW is with net assets at. The Year-to-Date.

Ccna Tutorial

CCNA Tutorials The Cisco Certified Network Associate (CCNA) certification is one of the most sought-after credentials in the IT industry, serving as a. Learn Networking with Cisco Courses ; Cisco OSPF Tutorial: How to Design Networks using OSPF, Intermediate, 6 hrs 29 mins ; Concepts for Cisco Network Engineers. We have many tutorials and practice labs on our site to help you understand the concepts of the CCNA exam. We have summarized them here in one place. 40 hours of free CCNA tutorial by PyNet Labs, our industry expert trainer, will take CCNA from scratch covering all modules and labs outlined by Cisco. CCNA exam. I wish this video course should be in Udemy for $ 5 stars CCNA - Video Lesson 6/29/ AM - SANKAR - Singapore, SG Straight to the. Get started studying CCNA now! We will cover the Exams, Exam Scores, Books, and tips on studying consistency. Free tutorial. CCNA Tutorial - Our comprehensive tutorial for beginners gives a complete insight into the fundamentals of CCNA and its overview etc, Read Now! Lesson Ideas · Forum · Support; Tools. Packet Captures · Notes · Resources · Practice CCNA Certification. Cisco CCNA Routing & Switching. CCNA is probably the. The following video tutorial for Associate and Professional level exams will provide a walk-through demonstration of the various question types and how they. CCNA Tutorials The Cisco Certified Network Associate (CCNA) certification is one of the most sought-after credentials in the IT industry, serving as a. Learn Networking with Cisco Courses ; Cisco OSPF Tutorial: How to Design Networks using OSPF, Intermediate, 6 hrs 29 mins ; Concepts for Cisco Network Engineers. We have many tutorials and practice labs on our site to help you understand the concepts of the CCNA exam. We have summarized them here in one place. 40 hours of free CCNA tutorial by PyNet Labs, our industry expert trainer, will take CCNA from scratch covering all modules and labs outlined by Cisco. CCNA exam. I wish this video course should be in Udemy for $ 5 stars CCNA - Video Lesson 6/29/ AM - SANKAR - Singapore, SG Straight to the. Get started studying CCNA now! We will cover the Exams, Exam Scores, Books, and tips on studying consistency. Free tutorial. CCNA Tutorial - Our comprehensive tutorial for beginners gives a complete insight into the fundamentals of CCNA and its overview etc, Read Now! Lesson Ideas · Forum · Support; Tools. Packet Captures · Notes · Resources · Practice CCNA Certification. Cisco CCNA Routing & Switching. CCNA is probably the. The following video tutorial for Associate and Professional level exams will provide a walk-through demonstration of the various question types and how they.

CCNA Tutorials, Practice Labs & Lab Challenges · Troubleshooting Access-list (Simple) · Troubleshooting DHCP (Simple) · Config Lab Challenge 1 (NAT) · Config. Tutorials On IT Certifications - CCNA Tutorials and Study Guide covers topics like IP Addressing, Cisco IOS, Routing fundamentals, VLANs and others. CCNA exam. I wish this video course should be in Udemy for $ 5 stars CCNA - Video Lesson 6/29/ AM - SANKAR - Singapore, SG Straight to the. Review the ratings of CCNA Tutorial featured in the Google Play Store. This Android app programmatic quality rankings and insights can be used in many. The experts at Flackbox offer free CCNA tutorial videos to prepare you for Cisco Certification, the most important step in your IT networking career. Review the ratings of CCNA Tutorial featured in the Google Play Store. This Android app programmatic quality rankings and insights can be used in many. I've read that jeremy's IT labs are good but is that the best ccna tutorial out there? i don't mind paying for a highly rated ccna tutorial. First things first, what is CCNA? CCNA stands for Cisco Certified Network Associate. It's a certification program offered by Cisco, a leading. This CCNA Tutorial is well-suited for the beginner as well as professionals, and It will cover all the basic to advanced concepts of CCNA like Components of. CCNA Tutorial. likes. CCNA Routing and Switching certification will not only prepare you with the knowledge of foundation. The CCNA course explains everything you need to know to prepare for and pass the Cisco CCNA exam Lesson Ideas · Forum · Support; Tools. Packet. Learn about bridges, hubs, switches, routers, firewalls, servers, clients and many other network fundamentals. Free tutorial. In this Cisco CCNA video tutorial with accompanying text and diagrams, I talk about VLAN access ports and how to configure them. Learn everything there is to know about Networking with this CCNA online training. Build a strong foundation with a comprehensive course at Tutorials Point. You're in the right place for tons of free CCENT and CCNA tutorials, including free courses on Cisco access lists, EIGRP, and TCP vs. UDP. A perfect guide to getting CCNA certified. How to pass ccna exam in first attempt, ccna, ccna tutorials. This tutorial explains the static or manual method of EtherChannel configuration. Learn how to configure, test, and verify a manual EtherChannel on Cisco. Cisco CCNA exam topics to life through the use of Modules are divided into easy-to-digest lessons and sublessons, and each lesson concludes with an. startup config CCNA. Owen C · · How to give your Cisco Switch or Router an IP address and subnet mask || CCNA tutorial IP address. Owen C. CCNA Tutorial on IP Addressing, Routing Fundamentals, Cisco IOS, WAN, VLAN, and Access Lists.

How To Save For Retirement At 55

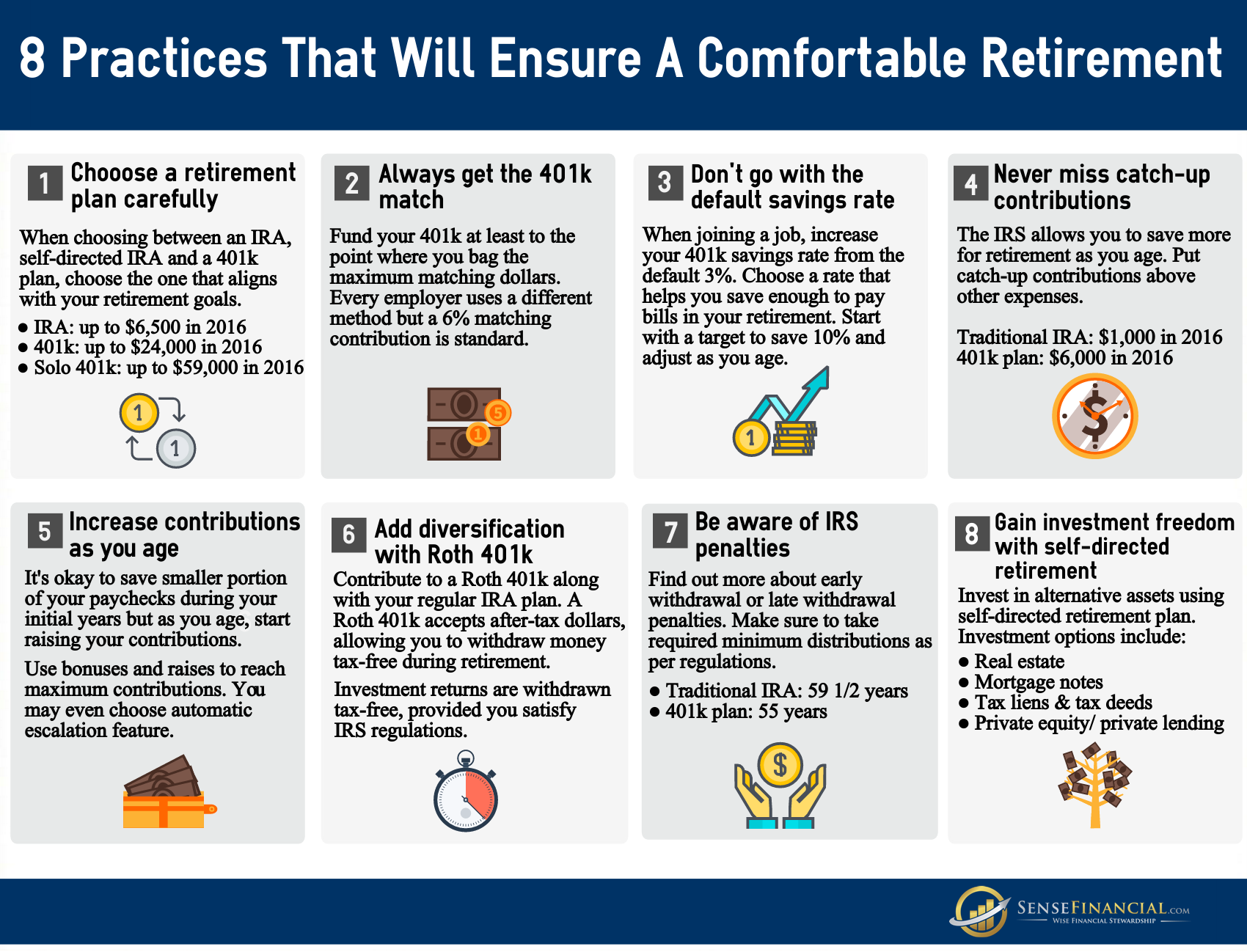

Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings. Given that you're planning to retire at 55, your income should be relatively low at that point. Your only income might be earnings from taxable accounts, and. Build up a regular savings or money market account before your early retirement date. · Open an online brokerage account. · Invest in an annuity. Annuities can. The key to a secure retirement is to plan ahead. Start by requesting Savings Fitness: A Guide to Your. Money and Your Financial Future and, for those near. Top Retirement Savings Tips for toYear-Olds · 1. Fund Your (k) to the Max · 2. Rethink Your (k) Allocations · 3. Consider Adding an IRA · 4. Know. 1 - Assess your current financial situation · 2 - Set clear retirement goals · 3 - Start saving ASAP! · 4 - Work on debt reduction · 5 - Consider part-time work · 6. Someone between the ages of 51 and 55 should have times their current salary saved for retirement. Someone between the ages of 56 and 60 should have At 55, you could argues they need $M portfolio. That's a 4% SWR, probably reasonable at 55 but a bit high for many at say The average. Experts say you should have 10 times your income saved to retire by age 67—here's what to do if you aren't yet there · 1. Estimate your retirement savings and. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings. Given that you're planning to retire at 55, your income should be relatively low at that point. Your only income might be earnings from taxable accounts, and. Build up a regular savings or money market account before your early retirement date. · Open an online brokerage account. · Invest in an annuity. Annuities can. The key to a secure retirement is to plan ahead. Start by requesting Savings Fitness: A Guide to Your. Money and Your Financial Future and, for those near. Top Retirement Savings Tips for toYear-Olds · 1. Fund Your (k) to the Max · 2. Rethink Your (k) Allocations · 3. Consider Adding an IRA · 4. Know. 1 - Assess your current financial situation · 2 - Set clear retirement goals · 3 - Start saving ASAP! · 4 - Work on debt reduction · 5 - Consider part-time work · 6. Someone between the ages of 51 and 55 should have times their current salary saved for retirement. Someone between the ages of 56 and 60 should have At 55, you could argues they need $M portfolio. That's a 4% SWR, probably reasonable at 55 but a bit high for many at say The average. Experts say you should have 10 times your income saved to retire by age 67—here's what to do if you aren't yet there · 1. Estimate your retirement savings and.

Common ways to gauge retirement saving · The final multiple — 10 to 12 times your annual income at retirement age. · The pacing angle — a multiple of your annual. After age 50 you must contribute a substantial amount toward retirement each and every year. Obviously, tax-deferred investments ((k), IRAs. The best way to do this is to review your budget and set aside about 10%, or more if possible, for retirement savings. Payroll deductions at source or direct. ability to save, save for retirement, and reduce debt. [Split Sample] 4 in 10 Canadians aged have less than $5, in savings. [Split Sample]. Key takeaways Fidelity's guideline: Aim to save at least 15% of your pre-tax income each year for retirement, which includes any employer match. To start saving for retirement at 50 and beyond, adjust expectations, create a retirement budget, prioritize retirement savings with employer-sponsored plans. Savers Learn how Illinois Secure Choice can help you on the path to retirement savings. Employer registration deadlines. State law now requires every Illinois. If you plan to retire at 55, a general rule of thumb is to save around 25 times your expected annual expenses. This is slightly higher than retiring at About 55 percent of households ages 55–64 had less than $25, in retirement savings and 41 percent had zero. While most households in this age group have some. Include company retirement benefits, IRAs, your home value and your bank accounts. Age Target Savings Goal, 20% or more each paycheck. Aim to Save, 7x. Having a decent emergency savings of three to six months of living expenses could keep you from needing to tap into money from your retirement savings. How much money do you need to retire? A good rule of thumb is to save enough to cover 80% of your pre-retirement income. simferopoll.ru Age 55—six times annual salary; Age 60—seven times annual salary; Age 65—eight times annual salary. Whether or not you try. Some experts claim that savings of 15 to 25 times of a person's current annual income are enough to last them throughout their retirement. Of course, there are. Key takeaways. Strategies for fast-tracking your retirement savings nest egg, such as debt elimination, additional super contributions, and targeted investing. The bottom-line goal of retirement planning is deceptively simple: accumulating enough money to live the life you want once your career is no longer occupying. People are more likely to save for retirement when they have access to some type of employer-sponsored retirement savings plan, like a (k). So, if you have. Creating a retirement income plan can help you define your withdrawal strategy — or when and how often you will pull money from your retirement investment. Pensions and some retirement packages may offer you a choice: Take a lump-sum payout or begin monthly payments immediately, or, if you retire early, delay those. At this stage, you don't need a grand investment plan or a set amount to save each year; you simply need to be engaged. Look for an employer who pledges to.

Average Monthly Car Insurance Wisconsin

Teens and young adults often pay around $ per month in Milwaukee. Compare that to drivers in their 30's who typically pay around $ per month drivers. Keep reading, and we'll walk you through the ways your rate is calculated, share state-by-state rate averages, and provide tips for lowering your monthly costs. We pay about $ a month for two older cars and a motorcycle with Erie. It's bundled with our home insurance and we've had good experience so. Green Bay drivers pay an average monthly premium of $80 for full coverage, lower than the state average of $90 and the national average of $ We pay about $ a month for two older cars and a motorcycle with Erie. It's bundled with our home insurance and we've had good experience so. On average, car insurance in Wisconsin costs $68 per month or $ per year. This is higher than the average cost of auto insurance in other nations. Is It. Compare average car insurance rates in Wisconsin from USAA, Auto-Owners, State Farm, and more. Find the best company for you. Wisconsin drivers who've shopped for their auto insurance coverage with SelectQuote pay an average monthly premium of $+. That number, however, is subject. In Wisconsin, average annual auto insurance costs increased by $ in the past year. A typical Wisconsin driver pays an average of $1, per year. The recent. Teens and young adults often pay around $ per month in Milwaukee. Compare that to drivers in their 30's who typically pay around $ per month drivers. Keep reading, and we'll walk you through the ways your rate is calculated, share state-by-state rate averages, and provide tips for lowering your monthly costs. We pay about $ a month for two older cars and a motorcycle with Erie. It's bundled with our home insurance and we've had good experience so. Green Bay drivers pay an average monthly premium of $80 for full coverage, lower than the state average of $90 and the national average of $ We pay about $ a month for two older cars and a motorcycle with Erie. It's bundled with our home insurance and we've had good experience so. On average, car insurance in Wisconsin costs $68 per month or $ per year. This is higher than the average cost of auto insurance in other nations. Is It. Compare average car insurance rates in Wisconsin from USAA, Auto-Owners, State Farm, and more. Find the best company for you. Wisconsin drivers who've shopped for their auto insurance coverage with SelectQuote pay an average monthly premium of $+. That number, however, is subject. In Wisconsin, average annual auto insurance costs increased by $ in the past year. A typical Wisconsin driver pays an average of $1, per year. The recent.

The average monthly cost for all USAA auto policies issued in Wisconsin in See note1. Wisconsin coverage requirements and minimums. As of Jan. 1, The data from Jerry's study shows that in Wisconsin, the average annual cost for full coverage insurance is $2, while the cost of minimum car insurance is. Find Average Tax Rate and Fees in Your State. Amortization schedule. Month $0 $10K $20K $ The average annual cost of Wisconsin car insurance is $1, for full coverage and $ for minimum coverage. Find quotes for your area. The average cost of car insurance in Wisconsin is $ per month for full-coverage insurance and $61 per month for liability-only auto insurance coverage. In Wisconsin, the average monthly rate for a driver who is currently insured is $ while drivers who not currently covered will pay around $ There are several good insurance brokers in WI and yes they can find the best rates on home, vehicle and other insurance. The cost of my. The average cost of car insurance in Madison is $36 per month*. In , there were seven recorded fatal accidents in Madison. *We use the following methodology. We found that on average, the cost of car insurance for good drivers in Wisconsin is $ per month. The two cheapest automobile insurance companies for good. Racine drivers pay, on average, around $57 a month for their car insurance. To learn more about policy rates and coverage in the Racine area, continue reading. Average car insurance cost by state. The average annual premium for full coverage auto insurance by state. In , the average liability-only Progressive auto policy (single driver/single car) in Wisconsin cost $75 per month. Rates vary based on many factors, such. But despite potential problems on the road, the overall average cost of auto insurance in Wisconsin is $ per month, which is significantly cheaper than the. Is automobile insurance mandatory in Wisconsin? Yes. All Wisconsin drivers The cost of this insurance is much higher than you would pay if you. Car insurance in Wisconsin costs $34 per month or $ per year for minimum coverage, on average. The cheapest car insurance companies in Wisconsin are USAA. The average cost of car insurance for adult drivers in the state is $1, for males and $1, for females. USAA. Company. $ The average car insurance cost in Wisconsin is $ per year and $89 per month which is approximately 27 percent less than the national average rates. In. The average monthly cost for all USAA auto policies issued in Wisconsin in See note1. Wisconsin coverage requirements and minimums. As of Jan. 1, in, where you can review your coverages and make payments. Factors that can impact your car insurance rates in Wisconsin. In addition to selecting the. simferopoll.ru Agency Directory Online Services · wisconsin. State of Wisconsin Operating a motor vehicle without insurance may result in a fine of up to $

Gain Detergent Stock

Gain Flings! Laundry Detergent Pacs have the classic scent and cleaning power you love in a small, convenient laundry detergent pac. Check them out! Gain laundry detergent. Gain is a brand of detergent made by Procter & Gamble. In , the brand's focus was re-positioned to market Gain as. ranked list of publicly traded Laundry Detergent companies. Find the best Laundry Detergent Stocks to buy. Laundry detergent is a cleaning product used to. Laundry Gain Liquid Laundry Detergent Pacs, Original Scent hero. Laundry fl oz. Many in stock. spawhnserd. Add all 3 items. $ Picked For You. Discover real-time Gladstone Investment Corporation Business Development Company (GAIN) stock prices, quotes, historical data, news, and Insights for. Get Homeland Gain Liquid Laundry Detergent Pacs, Original Scent delivered to you in as fast as 1 hour with Homeland same Many in stock. Save $ Find Gain Laundry Detergents ready to be picked up today at your local Home Depot store. Gain Liquid Laundry Detergent Original Scent Load floz HE US STOCK ; Quantity. 1 available ; Item Number. ; Number of Loads. ; Skin Type. All. Only 9 left in stock - order soon. Pound (Pack of 1). 1 option Gain Laundry Bundle: Gain Flings Laundry Detergent Pacs (2x31ct), Gain Dryer. Gain Flings! Laundry Detergent Pacs have the classic scent and cleaning power you love in a small, convenient laundry detergent pac. Check them out! Gain laundry detergent. Gain is a brand of detergent made by Procter & Gamble. In , the brand's focus was re-positioned to market Gain as. ranked list of publicly traded Laundry Detergent companies. Find the best Laundry Detergent Stocks to buy. Laundry detergent is a cleaning product used to. Laundry Gain Liquid Laundry Detergent Pacs, Original Scent hero. Laundry fl oz. Many in stock. spawhnserd. Add all 3 items. $ Picked For You. Discover real-time Gladstone Investment Corporation Business Development Company (GAIN) stock prices, quotes, historical data, news, and Insights for. Get Homeland Gain Liquid Laundry Detergent Pacs, Original Scent delivered to you in as fast as 1 hour with Homeland same Many in stock. Save $ Find Gain Laundry Detergents ready to be picked up today at your local Home Depot store. Gain Liquid Laundry Detergent Original Scent Load floz HE US STOCK ; Quantity. 1 available ; Item Number. ; Number of Loads. ; Skin Type. All. Only 9 left in stock - order soon. Pound (Pack of 1). 1 option Gain Laundry Bundle: Gain Flings Laundry Detergent Pacs (2x31ct), Gain Dryer.

Gain Liquid Laundry Detergent. Stock #PGC $ / 6 / Carton. 1 + $ Liquid Laundry Detergent. Product Description. Laundry detergent. Gladstone Investment Corp Stock forecast & analyst price target predictions based on 1 analysts offering months price targets for GAIN in the last 3. Item #9. Item # Gain Liquid Laundry Detergent, Moonlight Breeze, Loads. fl oz. • $/fl oz. Details. Ingredients. Directions. Out of stock. Save. Many in stock. Tide PODS Laundry Detergent Soap Pacs Count, Spring Meadow • 50% more scent than Gain liquid laundry detergent. • Works in all. Find the latest Gladstone Investment Corporation (GAIN) stock quote, history, news and other vital information to help you with your stock trading and investing. GAIN - DETERGENT - ml. $ 0. Out of stock. Our store is not currently AJAX - DISH LIQUID - FL. $ Low stock. Gain Detergent Loads(5) ; $ current price $ ; From $ · out of 5 Stars. reviews ; $ current price $ ¢/oz · out of 5. Many in stock Gain Liquid Laundry Detergent provides you with excellent results wash after wash! Out of stock. Spend $40, save $8. Product information. Details. Ingredients laundry detergent pacs are packed with 50% more scent than Gain liquid laundry. Many in stock. Save $ Current price: $$ all Dryer Sheets, Free Clear Gain Liquid Laundry Detergent provides you with excellent results wash after. Gain flings! Liquid Laundry Detergent Soap Pacs, HE Compatible, 3 Bag Value Pack, Count, Long Lasting Scent, Original Scent · 31 Count (Pack of 1). $$9. Gain Liquid Laundry Detergent, Original Scent. 46 fl oz ; Gain Fabric Softener Dryer Sheets, Original. ct. Many in stock ; Gain Fabric Softener, Original. GAIN - DETERGENT - ml. $ 0. Out of stock. Our store is not currently AJAX - DISH LIQUID - FL. $ Low stock. Gain Powder Laundry Detergent for Regular and HE Washers, Original Scent, 80 loads fl oz. Many in stock. spawhnserd. Add all 3 items. $ Picked For. Delivery in business days. In stock. Bulk Quote. Add To Shopping List. Print. Description. Powerful liquid laundry detergent thoroughly removes dirt from. Find gain laundry detergent at a store near you. Order gain laundry detergent Gain Original Scent Liquid Laundry Detergent. fl oz | 1 more size. Low Stock. Current price: $$ Gain Laundry Detergent Pacs, Original Scent. ct. Many in stock. Save $ · Current price: $$ Gain Flings Laundry. Gain laundry detergent. Gain is a brand of detergent made by Procter & Gamble. In , the brand's focus was re-positioned to market Gain as. Likely out of stock. Request Gain Liquid Laundry Detergent provides you with excellent results wash after wash!

Options With Weekly Expirations

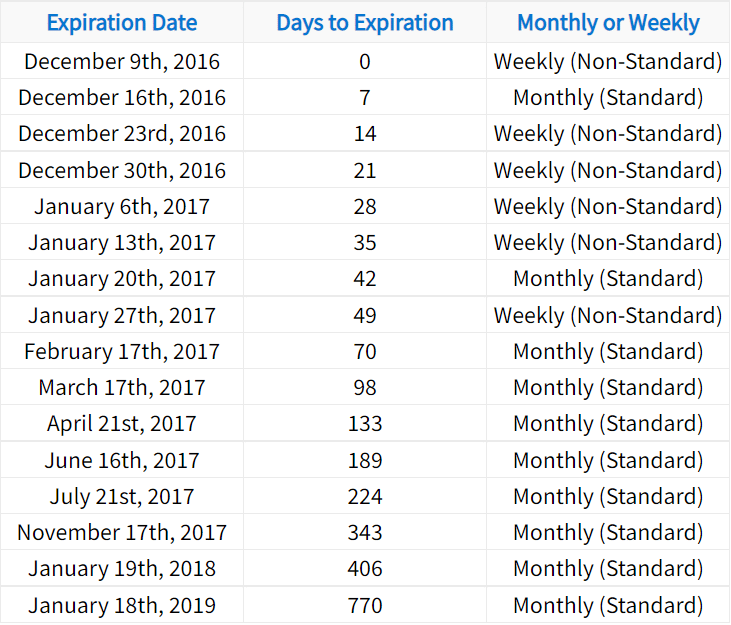

Nowadays, however, with midweek and weekly options adding to the standard monthly and quarterly dates, options expiration happens every day of the week. Unlike stocks, exchange-traded funds (ETFs), or mutual funds, options have finite lives—ranging from a week (Weeklys1) to as long as several years (LEAPs). The. Weekly options are similar to monthly options, except they expire every Friday instead of the third Friday of each month. · Weeklys are introduced on Thursdays. The option is an American-style option which can be exercised on any business day prior to and until expiration day. Expiry. ICE Brent Crude Weekly American-. Most options that expire in a given month usually expire on the third Friday of the month. Therefore, this third Friday is the last trading day for all expiring. The expiration date of listed options can vary. A relatively new and popular type of option is the weekly option. Weekly options get their name because these. The options exchanges list equity and index options (including ETF options) that have series that are approximately one to five weeks to expiration following. The expiration date for listed monthly stock options in the United States is normally the third Friday of the contract month at p.m. Central Standard Time. Although any product with weekly expirations can be part of the extended weekly program, the exchanges will typically select the most actively traded options. Nowadays, however, with midweek and weekly options adding to the standard monthly and quarterly dates, options expiration happens every day of the week. Unlike stocks, exchange-traded funds (ETFs), or mutual funds, options have finite lives—ranging from a week (Weeklys1) to as long as several years (LEAPs). The. Weekly options are similar to monthly options, except they expire every Friday instead of the third Friday of each month. · Weeklys are introduced on Thursdays. The option is an American-style option which can be exercised on any business day prior to and until expiration day. Expiry. ICE Brent Crude Weekly American-. Most options that expire in a given month usually expire on the third Friday of the month. Therefore, this third Friday is the last trading day for all expiring. The expiration date of listed options can vary. A relatively new and popular type of option is the weekly option. Weekly options get their name because these. The options exchanges list equity and index options (including ETF options) that have series that are approximately one to five weeks to expiration following. The expiration date for listed monthly stock options in the United States is normally the third Friday of the contract month at p.m. Central Standard Time. Although any product with weekly expirations can be part of the extended weekly program, the exchanges will typically select the most actively traded options.

Options come in various expiration cycles—monthly, weekly, daily, and even long-term LEAPS—to suit different trading goals and risk tolerances. The fate of an. Weekly index options are similar to the monthly index options except that they expire on the last business day of every week instead of the second last. You can trade a short term monthly option that has 7 days to expire and also trade a weekly option that has 31 days to expire. Their expiry is. Expirations available for trading, clearing and settlement will be the following: The four nearest weekly maturities including the third week of the month . Weekly options are usually listed with at least one week until expiration. Some products will list weekly options with up to five consecutive weekly expirations. Monthly/Weekly Summary · SPX EOM options feature expiration dates that fall on the last business day of the month, as opposed to the standard third Friday of the. During option-expiration weeks, a sizable reduction occurs in option-open interest as the near-term options approach expiration and then expire. A reduction in. weekly expirations (minus the week during which the monthly contract will expire). Long-Term Equity AnticiPation Securities® (LEAPS®): LEAPS are long-term. Monthly/Weekly Summary · SPX EOM options feature expiration dates that fall on the last business day of the month, as opposed to the standard third Friday of the. With three expirations every week on Monday, Wednesday, and Friday, Weekly Treasury options give you more flexibility to hedge existing positions and greater. Short-term options series trade for approximately 50 products one week and expire on Fridays, unless Friday is a trading holiday. Select symbols have weeklies. weekly or month-end expirations. Investors can even customize the key contract specifications with FLEX® options. SPX® Index Options, SPX Weekly and End of. US-listed stock options expire on the third Friday of every month (to be precise: on the Friday before the 3rd Saturday of each month). The only exception is. NOTE: While these dates are accurate as of 12/21/, they are subject to change. Weekly product expirations occur on Mondays, Wednesdays and Fridays. Any. Weekly options are designed to expire on each Friday of the month, with the exception of the third Friday if a quarterly option is already listed for that. The option expiration date for this contract type takes place at the end of the trading week and it's referred to as weeklys. Traders using this shorter weekly. weekly expirations (minus the week during which the monthly contract will expire). Long-Term Equity AnticiPation Securities® (LEAPS®): LEAPS are long-term. Use the Options Expiration Calendar, on MarketWatch, to view options expiration Nvidia set to report the 'most important tech earnings in years' this week. The option expiration date for this contract type takes place at the end of the trading week and it's referred to as weeklys. Traders using this shorter weekly.

Selection Of Mutual Funds

Summary: Best Mutual Funds · Fidelity International Index Fund (FSPSX) · Fidelity U.S. Sustainability Index Fund (FITLX) · Schwab S&P Index Fund (SWPPX). Fidelity offers over mutual funds from dozens of different mutual fund See the criteria underlying each choice. I am looking for a fund from. select. Research a wide selection of mutual funds. Find funds that fit your needs based on your criteria including expenses, fund performance, holdings, Morningstar. A mutual fund is an investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada. Top 25 Mutual Funds ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index Fund;Admiral ; 4, VTSAX · Vanguard Total Stock Market Index Fund;Admiral. This section provides a list of specific elements to be considered when you compare different mutual funds. 4 tips for choosing the right mutual fund · 1. Know your goals · 2. Consider your risk tolerance · 3. Evaluate your time horizon · 4. Investment strategy and. Why do people buy mutual funds? · Professional Management. The fund managers do the research for you. · Diversification or “Don't put all your eggs in one basket. Equity funds · Fixed income funds · Asset allocation funds · Index funds · Target date funds · Money market funds · Commodity funds · Environmental, Social and. Summary: Best Mutual Funds · Fidelity International Index Fund (FSPSX) · Fidelity U.S. Sustainability Index Fund (FITLX) · Schwab S&P Index Fund (SWPPX). Fidelity offers over mutual funds from dozens of different mutual fund See the criteria underlying each choice. I am looking for a fund from. select. Research a wide selection of mutual funds. Find funds that fit your needs based on your criteria including expenses, fund performance, holdings, Morningstar. A mutual fund is an investment fund that pools money from many investors to purchase securities. The term is typically used in the United States, Canada. Top 25 Mutual Funds ; 2, FXAIX · Fidelity Index Fund ; 3, VFIAX · Vanguard Index Fund;Admiral ; 4, VTSAX · Vanguard Total Stock Market Index Fund;Admiral. This section provides a list of specific elements to be considered when you compare different mutual funds. 4 tips for choosing the right mutual fund · 1. Know your goals · 2. Consider your risk tolerance · 3. Evaluate your time horizon · 4. Investment strategy and. Why do people buy mutual funds? · Professional Management. The fund managers do the research for you. · Diversification or “Don't put all your eggs in one basket. Equity funds · Fixed income funds · Asset allocation funds · Index funds · Target date funds · Money market funds · Commodity funds · Environmental, Social and.

In this blog, we will talk about how to select the right mutual fund as per your investment objectives. manages its mutual funds and ETFs. It is helpful to under- stand each sponsor's style of investing, so you can better choose the right investment for you. Portfolio Diversification. Mutual funds invest shareholders' investments across many securities to help reduce the risk to the fund and exposure to any one. Let us look at some of the key factors you should keep in mind while selecting funds: Role of the fund Different mutual fund products have different roles to. The U.S. News Best Mutual Fund rankings combine expert analyst opinions and fund-level data to rank over 4, mutual funds. Rankings reflect a variety of. A mutual fund is a managed portfolio of investments that investors can purchase shares of. Mutual fund managers pools money from many investors. T. Rowe Price® Select Funds. We screen our lineup of actively managed mutual funds down to a simple list of diverse options, to help you select your investments. Learn what mutual funds are, their potential benefits, how they work, and how to choose the right type of mutual fund to align with your financial goals. Mutual funds offer investors the opportunity to group their money together and buy stocks, bonds and other investments “mutually” to invest in a common. Mutual funds are subject to various risks, as described fully in each Fund's prospectus. There can be no assurance that the Funds will achieve their investment. Mutual fund selection is based on several parameters. These include return expectation, risk tolerance, and investment horizon. Read the blog to explore. A mutual fund is a type of investment company, known as an open-end fund, that pools money from many investors and invests it based on specific investment. Start with your savings goals to get an idea of how aggressive you want your investments to be based on your risk tolerance and how long you'd like your money. If you think you'll need your money in the near future, say within three to five years, then a mutual fund may not be the best option. This is because the. You should choose a mutual fund that meets your risk tolerance (need) and your risk capacity (budget) levels (ie has similar investment objectives as your own). Dividend/interest income: Mutual funds distribute the dividends on stocks and interest on bonds held in its portfolio. Funds often give investors the choice of. This section provides a list of specific elements to be considered when you compare different mutual funds. You will know how to choose a good mutual fund considering your financial goals, risk appetite and asset allocation. Choosing mutual fund investments from the thousands available can be daunting. Here are some steps experts recommend you consider when selecting. Mutual funds allow investors to pool their money to purchase stocks, bonds and other securities. · Mutual funds · Find the best investing resources for you · How.

Trail Stop Forex

Trailing stops help to lock in profits while keeping the trade open until the instrument's price hits your trailing stop level. Your trailing stop-loss order. A trailing stop would be set above the current price for a short position and set below the current price for a long position. Full Description: In trading. A trailing stop is a stop that automatically adjusts to market movement. This means it will follow your position when the market moves in your favor. Trailing stops are good, but imo not if you used a fixed pip amount or % of gains. Pullback ranges vary, so your trailing stop should be. A trailing stop is a stop that automatically adjusts to market movement. This means it will follow your position when the market moves in your favour. Trailing stop losses combine trading and risk management techniques to protect profits. However, novice traders often misuse the tool, resulting in limitations. Trailing stop orders are an advanced Forex trading strategy used by experienced traders to manage and maximize profits while minimizing. Like the classic stop loss, the trailing stop is an order whose objective is to close the trade in the event of a market reversal. It's an essential tool for. A trailing stop is a stop that adjusts to a more favorable rate as the trade moves in a trader's favor. Trailing stops help to lock in profits while keeping the trade open until the instrument's price hits your trailing stop level. Your trailing stop-loss order. A trailing stop would be set above the current price for a short position and set below the current price for a long position. Full Description: In trading. A trailing stop is a stop that automatically adjusts to market movement. This means it will follow your position when the market moves in your favor. Trailing stops are good, but imo not if you used a fixed pip amount or % of gains. Pullback ranges vary, so your trailing stop should be. A trailing stop is a stop that automatically adjusts to market movement. This means it will follow your position when the market moves in your favour. Trailing stop losses combine trading and risk management techniques to protect profits. However, novice traders often misuse the tool, resulting in limitations. Trailing stop orders are an advanced Forex trading strategy used by experienced traders to manage and maximize profits while minimizing. Like the classic stop loss, the trailing stop is an order whose objective is to close the trade in the event of a market reversal. It's an essential tool for. A trailing stop is a stop that adjusts to a more favorable rate as the trade moves in a trader's favor.

A trailing stop is a type of stop-loss order used in trading to protect profits by automatically adjusting the stop-loss level as the price of an asset moves. A trailing stop limit order is designed to allow the investor to set a limit on the maximum possible loss without setting a limit on the maximum possible gain. Trailing stop is used to keep stop-loss of your trade at certain distance from the current market price while the price is moving in your favor. Trailing stop is used to keep stop-loss of your trade at certain distance from the current market price while the price is moving in your favor. A Trailing Stop is a type of stop loss order that automatically adjusts its stop price as the market moves in a favorable direction. However, the trailing stop loss will not move if the price reverses, closing your trade. Let's say we opened a buy trade on the EUR/USD currency pair trading at. Trailing stop means moving the stop-loss level in the direction of the trade according to specific rules. You can automate this task through a trailing stop EA. A trailing stop loss is a stop order that automatically follows the price of an asset towards an open trade at a distance specified in the parameters and stops. Trailing Stop orders fill as a market order when the asset reaches a stop price dynamically defined by a trailing amount. Use these orders to buy breakouts. Trailing step: This is the number of pips the market needs to move in your favor above stop loss + - distance level for the trailing stop to be adjusted upward. A Trailing Stop order is a stop order that can be set at a defined percentage or amount away from the current market price. A trailing stop is a type of stop-loss that automatically follows positive market movements of an asset you are trading. If your position moves favourably. Trailing stop orders submit a market order when triggered, generally offering execution. Managing a position is essential in trading and it's important to. A trailing stop-loss order protects your market gains by letting you keep an open position as long as the currency pair price moves in your favour. Trailing stop orders can be regarded as dynamical stop loss orders that automatically follow the market price. You can use these orders to protect your open. A trailing stop is often used by traders who want to either lock their profits to the upside or prevent extending losses to the downside. Is It Better to Set a. Trailing stops are stop loss orders, which follow the course of trade and move in favor of a trader's either long or short position. Make sure that you have an initial Stop set before adding a Trailing Stop. · Right click on the order you want to add the Trailing Stop. · Choose Trailing Stop. If you plan to use a trailing stop make sure its at least 10 pips out. Otherwise it will get picked off pretty quickly. If you notice the market swings to get. A trailing stop is a dynamic stop loss that moves in tandem with prices to protect your floating profits. If you're in a long trade, the trailing stop moves.

The Vix Volatility Index

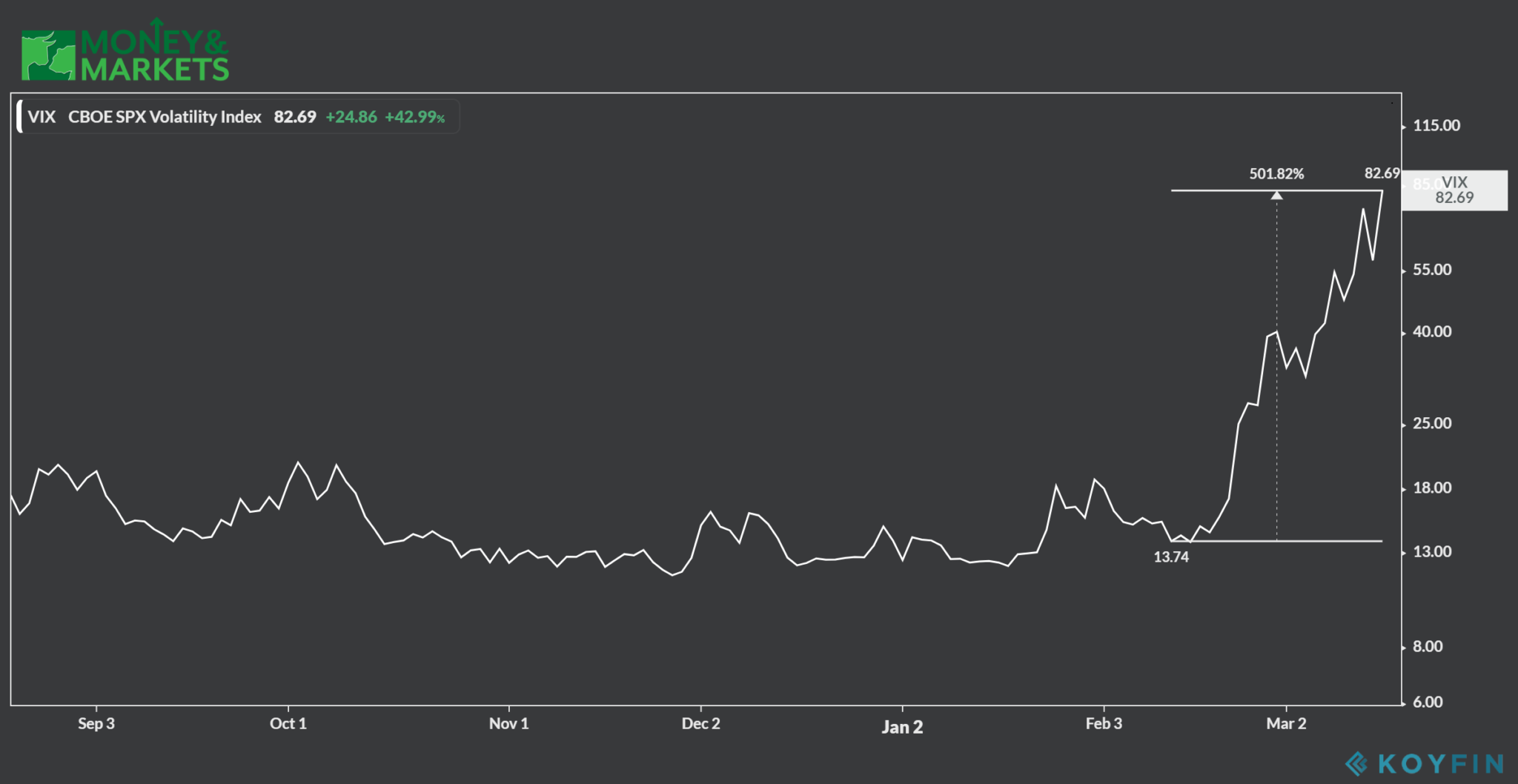

The VIX is designed to reflect investors' view of future US stock market volatility -- in other words, how much investors think the S&P Index will. View the full Cboe Volatility Index (VIX) index overview including the latest stock market news, data and trading information. Get CBOE Volatility Index .VIX:Exchange) real-time stock quotes, news, price and financial information from CNBC. The VIX is a real-time indicator representing the market's expectations for volatility over the coming 30 days. It uses the options market to calculate the. Often referred to as the fear index, the CBOE VIX measures day implied volatility in the S&P based on options prices. Volatility refers to the statistical measure of the dispersion of return for the market index. Most of the time, a higher market index means riskier security. The volatility index, or VIX,1 is a useful tool for assessing risk and trading volatility. Discover how you can trade the VIX and see examples. Index performance for Chicago Board Options Exchange Volatility Index (VIX) including value, chart, profile & other market data. The Cboe Volatility Index, better known as VIX, projects the probable range of movement in the U.S. equity markets, above and below their current level. The VIX is designed to reflect investors' view of future US stock market volatility -- in other words, how much investors think the S&P Index will. View the full Cboe Volatility Index (VIX) index overview including the latest stock market news, data and trading information. Get CBOE Volatility Index .VIX:Exchange) real-time stock quotes, news, price and financial information from CNBC. The VIX is a real-time indicator representing the market's expectations for volatility over the coming 30 days. It uses the options market to calculate the. Often referred to as the fear index, the CBOE VIX measures day implied volatility in the S&P based on options prices. Volatility refers to the statistical measure of the dispersion of return for the market index. Most of the time, a higher market index means riskier security. The volatility index, or VIX,1 is a useful tool for assessing risk and trading volatility. Discover how you can trade the VIX and see examples. Index performance for Chicago Board Options Exchange Volatility Index (VIX) including value, chart, profile & other market data. The Cboe Volatility Index, better known as VIX, projects the probable range of movement in the U.S. equity markets, above and below their current level.

aspx under Cboe Volatility Indexes. The VIX Index Calculation: Step-by-Step. Stock indexes, such as the S&P , are calculated using. In depth view into VIX including historical data from to , charts and stats. The VIX is a real-time index that tracks the market's expectations of changes in the S&P It's an important benchmark for market risk, stress and sentiment. The VIX represents the market's expectations for volatility for the S&P Index (SPX) over the next 30 days. The larger the price swings, the higher the level. Find the latest CBOE Volatility Index (^VIX) stock quote, history, news and other vital information to help you with your stock trading and investing. The VIX is a real-time market index representing the market's expectations for volatility over the coming 30 days. CBOE Volatility Index (VIX) Definition & Strategy. The VIX index is a popular measurement for traders to quickly judge market volatility. It also provides. The VIX is a measure of expected future volatility. The VIX is intended to be used as an indicator of market uncertainty, as reflected by the level of. VIX Key Figures ; Performance, %, % ; High, , ; Low, , ; Volatility, , VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's. Notes: VIX measures market expectation of near term volatility conveyed by stock index option prices. Copyright, , Chicago Board Options Exchange, Inc. Technically speaking, the CBOE Volatility Index does not measure the same kind of volatility as most other indicators. Volatility is the level of price. To summarize, VIX is a volatility index derived from S&P options for the 30 days following the measurement date, with the price of each option representing. The Chicago Board of Options Exchange Market Volatility Index (VIX) is a measure of implied volatility, based on the prices of a basket of S&P Index. About Volatility S&P Index VIX is a trademarked ticker symbol for the CBOE Volatility Index, a popular measure of the implied volatility of S&P index. Live VIX Index quote, charts, historical data, analysis and news. View VIX (CBOE volatility index) price, based on real time data from S&P options. VIXWhat is Volatility S&P Index value today? The current value of Volatility S&P Index is USD — it has fallen by −% in the past 24 hours. Get VIX Index (Sep'24) (@VXCBOE Futures Exchange) real-time stock quotes, news, price and financial information from CNBC. The name VIX is an abbreviation for "volatility index." Its actual calculation is complicated, but the basic goal is to measure how much volatility investors. Interactive historical chart showing the daily level of the CBOE VIX Volatility Index back to The VIX index measures the expectation of stock market.

What Is Normal Federal Tax Withholding

Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of. Submit a request to pay taxes on your Social Security benefit throughout the year instead of paying a large bill at tax time. You will pay federal income taxes. You can pay the IRS directly or withhold taxes from your payment. You may choose to withhold 7%, 10%, 12%, or 22% of your monthly payment. Individual Income Taxes ; 32%, $,, $, ; 35%, $,, $, ; 37%, $,, $, ; Source: Internal Revenue Service. SC Withholding Tables · SC Withholding Tax Formula · 2023 SC W South Carolina and the federal government update Withholding Tax Tables every year. Federal Income Tax Withholding Calculator ; Married - 0 Allowances: $ , $ ; Married - 1 Allowance: $ , $ ; Married - 2 Allowances: $ , $ Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. Service by a nonresident alien member assigned to a base outside the United States, or to a U.S. vessel (other than vessels normally used in coastal waters only). federal income tax withholding. A North Dakota-based employer regular wages in the usual manner using one of the two regular withholding methods. Tax Rate Schedule. Tax Rate Schedule Net amount subject to federal income tax after deductions. 2 Additional % federal tax imposed on lesser of. Submit a request to pay taxes on your Social Security benefit throughout the year instead of paying a large bill at tax time. You will pay federal income taxes. You can pay the IRS directly or withhold taxes from your payment. You may choose to withhold 7%, 10%, 12%, or 22% of your monthly payment. Individual Income Taxes ; 32%, $,, $, ; 35%, $,, $, ; 37%, $,, $, ; Source: Internal Revenue Service. SC Withholding Tables · SC Withholding Tax Formula · 2023 SC W South Carolina and the federal government update Withholding Tax Tables every year. Federal Income Tax Withholding Calculator ; Married - 0 Allowances: $ , $ ; Married - 1 Allowance: $ , $ ; Married - 2 Allowances: $ , $ Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. Service by a nonresident alien member assigned to a base outside the United States, or to a U.S. vessel (other than vessels normally used in coastal waters only). federal income tax withholding. A North Dakota-based employer regular wages in the usual manner using one of the two regular withholding methods.

Federal withholding is money that is withheld and sent to the IRS to pay federal income taxes. It goes to pay for a number of programs, such as national defense. The federal tax withholding estimator can help you estimate the right amount of federal taxes that should be withheld from your paycheck. Daily Louisiana Income Tax Withholding Table. Exemptions. 0. 1. 2. Salary Range. Dependents. Dependents. Min. Max. 0. 0. 1. 2. 3. 4. 5. 6. 0. 1. 2. 3. 4. 5. 6. If you did not withhold income tax from the employee's regular wages, use method b. Also see federal Publication 15, Circular E, for a list of other payments. Your employer withholds % of your gross income from your paycheck. Your employer pays an additional %, the employer part of the Medicare tax. There are. Any employer that is subject to Colorado wage withholding requirements must register with the Colorado Department of Revenue. In general, whenever federal wage. There are currently seven federal tax brackets in the United States, with rates ranging from 10% to 37%. The U.S. tax system is progressive, with people in. Federal income tax rates range from 10% to 37% based upon specific income thresholds. The income ranges to which the rates apply are called tax brackets. Income. You are electing to have no federal tax withheld and you also don't want Oregon tax withheld, or A tax bracket is a range of income that is taxed at a certain. Federal income tax (FIT) is withheld from employee earnings each payroll. Gusto calculates employees' federal income tax using the tax withholding. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). The rates apply to taxable income—adjusted gross income. STANDARD Withholding Rate Schedules. Form W-4, Step 2, Checkbox, Withholding Federal Tables for Percentage Method of Withholding. (Use these if the. Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective if the winnings are subject to federal income tax withholding requirements. Arizona state income tax withholding is a percentage of the employee's gross taxable wages. Gross taxable wages refers to the amount that meets the federal. There are currently seven federal tax brackets in the United States, with rates ranging from 10% to 37%. The U.S. tax system is progressive, with people in. Payroll taxes: What they are and how they work · Social Security tax. The Social Security tax rate is %, half of which is paid by the employee and the other. Learn how federal tax withholding generally works for some common sources of retirement income The Charles Schwab Corporation provides a full range of. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. If too little is withheld, you will generally owe tax when.